The National Bureau for Revenue (NBR) in Bahrain has issues technical guide in relation to Input VAT Recovery on costs relating to motor vehicles and mobile phones where there is both business and personal use.

NBR comes up with two

APMH Moores Rowland Knowledge Desk

Blog Authors

Latest from APMH Moores Rowland Knowledge Desk

Guide on One Time Payment of Tax Scheme, 2019

The Maharashtra State Government has notified a scheme named One Time Payment of Tax Scheme,2019. (hereinafter referred to as the ‘OTPT Scheme’) vide notification No. PFT.1218/C.R.52/Taxation-3 dated 22nd February,2019 under The Maharashtra State Tax on Professions, Trades, Callings and Employments…

Provisions relating to Transfer of Share by Private Companies

1.Instrument for Transfer of Share is compulsory: Section 56 provides that a company shall not register a transfer of shares of, the company, unless a proper transfer deed in Form SH.4 as given in Rule 11 of Companies (Share Capital…

Impact of Anti-Profiteering Provisions on the Real Estate Sector

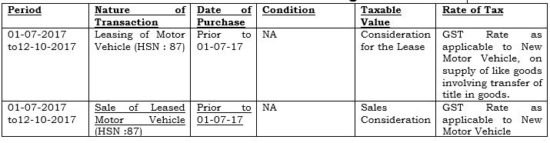

Applicability of GST on Sale of Used/Old Motor Vehicle

Transmission of Shares

A transmission of interest in shares of a company, of a deceased member of the company, made by the legal representative of a deceased member shall be considered as transmission of shares by operation of law. This transmission will be…

Reversal of Input Tax Credit under Rule 42 & 43 of CGST Rules, 2017

Understanding Detention of Vehicle Due to Defective Eway Bill or Without Eway Bill

As we are aware eway bill has been made mandatory to be accompanied with the conveyance for movement w.e.f. 01-04-2018, for any goods from one location to another in normal circumstances, except a small list and situations which are exempted…

Treatment of Sales Promotion Schemes under GST

Registering a Private Limited Company in India

A Private Limited Company registration in India is customary for starting a new business. This structure is developed under the organized business sector governed by specific Act and provisions.

A company in India is incorporated and registered under the Companies…